The Battle for the Login Box: An Analysis of the IAM Market Share

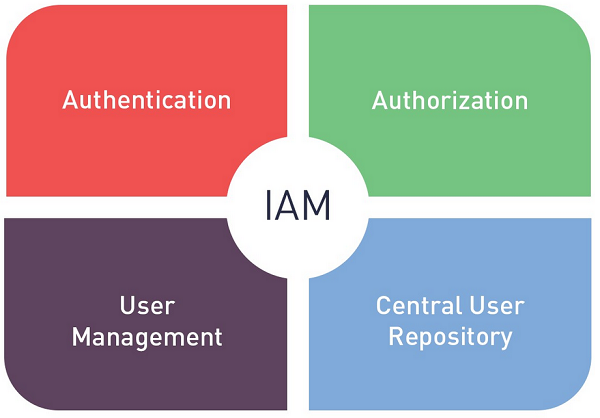

The global market for identity and access management is a high-stakes and intensely competitive arena, with the Identity and Access Management Market Share dominated by a few major platform vendors who have established themselves as the "digital gatekeepers" for the enterprise. The battle for leadership is fought on several key fronts: the breadth and depth of the identity platform, the ability to secure access to both cloud and on-premise applications, the quality of the end-user experience, and the strength of the developer ecosystem. While a few key players have a commanding lead, particularly in the cloud-based Identity-as-a-Service (IDaaS) space, the market is a complex ecosystem that also includes legacy on-premise giants, major cloud providers, and a host of specialized point solution vendors.

A dominant portion of the market share, especially in the pure-play cloud identity space, is held by Okta. Okta has established itself as a market leader by focusing exclusively on providing a comprehensive, user-friendly, and vendor-neutral IDaaS platform. Its success is built on its vast library of pre-built integrations (the Okta Integration Network), which makes it easy to connect to thousands of different SaaS applications to provide Single Sign-On (SSO). Its acquisition of Auth0 gave it a commanding position in the developer-focused, customer identity (CIAM) market as well. Ping Identity is another major pure-play competitor with a strong foothold in the large enterprise market, known for its flexibility and its ability to handle complex, hybrid IT environments.

The most powerful force in the entire IAM market, however, is Microsoft. With its Azure Active Directory (now Microsoft Entra ID), Microsoft has a massive and almost unparalleled market share. Its key advantage is that Azure AD is the identity layer for the entire Microsoft ecosystem, including Microsoft 365, which is used by hundreds of millions of enterprise users. For the vast majority of businesses that run on Microsoft, using Azure AD as their primary identity provider is the default and most deeply integrated choice. Microsoft has been aggressively expanding its capabilities, moving from a simple directory to a full-featured IAM platform with advanced governance and security features, making it a formidable competitor to all other vendors in the market.

The competitive landscape is further populated by a number of other significant players. Large, legacy enterprise software vendors like Oracle and Broadcom (with its Symantec portfolio) still have a significant share of the market, particularly with their long-standing on-premise identity and access governance solutions in large, complex enterprises. The market also includes a wide range of specialized vendors who focus on a specific part of the IAM puzzle, such as Identity Governance and Administration (IGA) specialists like SailPoint, or Privileged Access Management (PAM) leaders like CyberArk. The strategies for winning market share are now focused on building a complete, unified "identity fabric" that can secure every type of identity (human and machine) accessing every type of resource (cloud and on-premise) under a single, intelligent policy engine.

Other Exclusive Reports:

Enterprise Data Warehouse Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness